Liquidity Providers (LPs) are the backbone of decentralised finance (DeFi), supplying the assets that enable trading on decentralised exchanges (DEXes). On Solana, LP positions hold the promise of substantial earnings. However, while millions of dollars in fees are generated daily, only a handful of wallets seem to reap the rewards.

Why do so many LP positions underperform?

In this article, we’ll explore the earning potential on Solana, the critical role of Jupiter as a DEX aggregator, how DEXes optimise for discoverability, and what LPers should consider before jumping in—all backed by data and facts.

The Jupiter effect: How routing shapes LP success

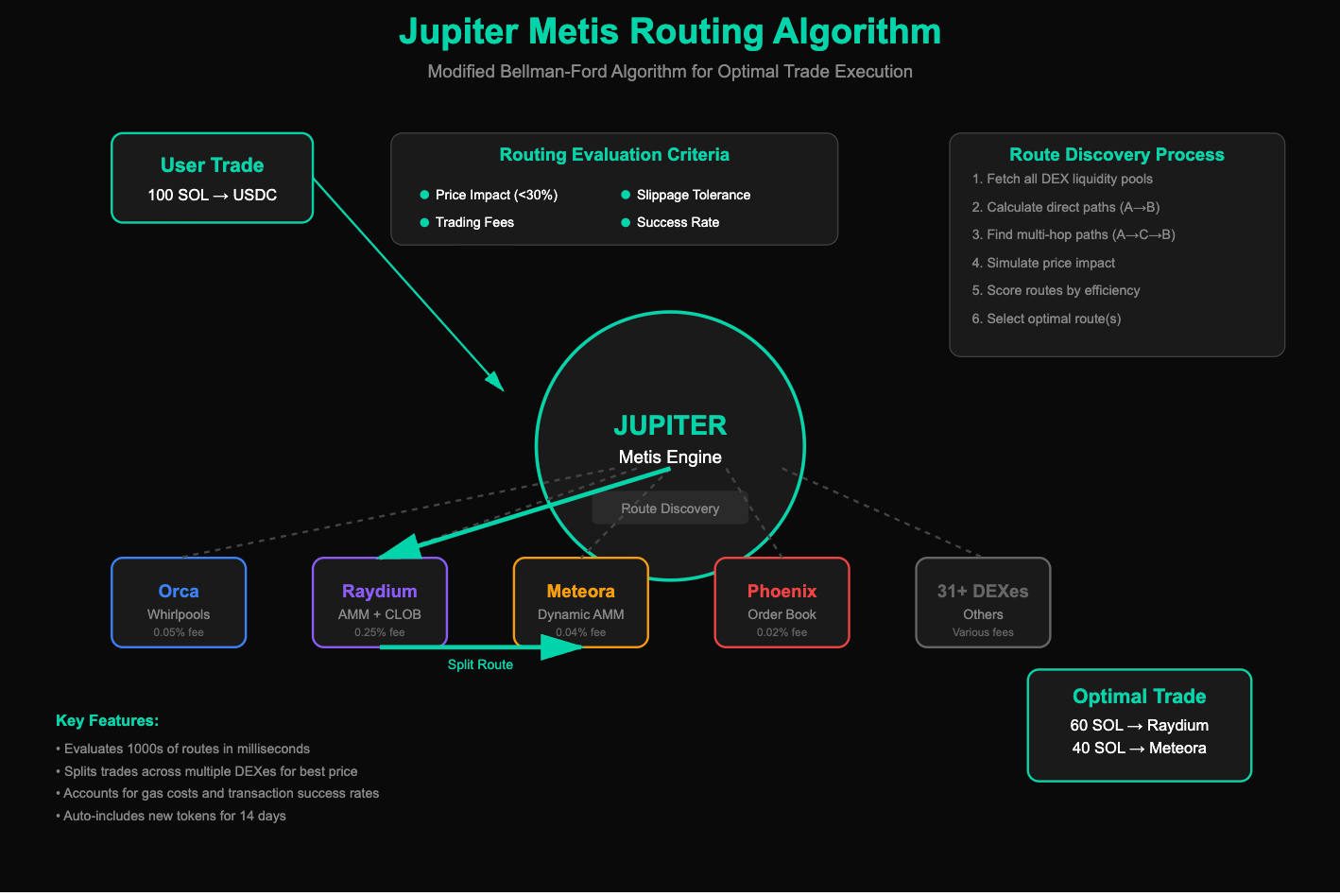

Jupiter aggregator serves as Solana's "front door," processing over 70% of DEX volume through its sophisticated Metis algorithm - a heavily modified Bellman-Ford variant that routes trades across 31+ integrated DEXes. This routing engine fundamentally determines which pools receive order flow and generate fees.

The algorithm evaluates routes based on price impact, slippage, fees, and execution success rates. It automatically includes new tokens for 14 days regardless of liquidity, but afterwards applies strict requirements: pools must handle $500 positions with less than 30% price impact. Jupiter +3 This creates a winner-take-all dynamic where well-optimised pools capture the majority of volume.

So choosing the dexes which help you with discoverability is a must.

Which DEXes win at discoverability?

Analysis of DEX implementations reveals clear winners in the Jupiter routing game. Orca leads the pack with standardised pool interfaces, efficient tick-based pricing, and comprehensive SDK support that makes integration seamless. Their Whirlpools concentrated liquidity model allows for precise price ranges, attracting more sophisticated routing.

Raydium follows closely, leveraging its hybrid AMM-CLOB (Central Limit Order Book) design. By integrating with OpenBook, Raydium pools benefit from additional liquidity sources, making them attractive for larger trades. Their multiple pool types—from standard AMMs to concentrated liquidity—provide flexibility that Jupiter's algorithm rewards.

Meteora has emerged as a dark horse, offering dynamic fee tiers that adjust based on market conditions. This adaptability helps maintain competitive pricing even during volatile periods. Meanwhile, Phoenix brings pure order book functionality to Solana, excelling in tight spreads for liquid pairs.

So, summing up, why do your LP positions suck?

You do not check which LP pool the trades are going through. You should care about:

Liquidity Depth

Fees generated

If trades are already going through that pool.

You do not have analytical tools to calculate real-time impermanent loss and are not able to make trading decisions.

You do not understand the difference between bin steps, ticks, and why trades would go through the pool they are going.

The harsh reality is that Solana LP provision has professionalised beyond casual participation. There are a lot of tools that try to make it easier, and hopefully it does get better.