Hedge Against Inflation, Embrace Stability: The Rise of Flatcoins

Broadens the scope beyond just crypto

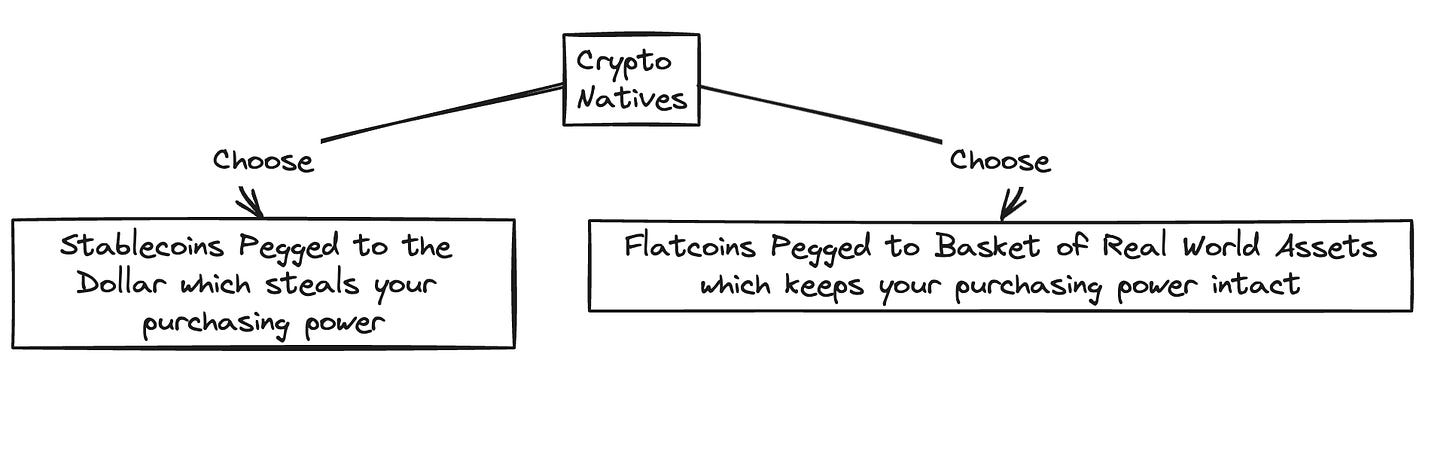

The cryptocurrency revolution promised a haven from the volatility and perceived injustices of traditional finance. Yet, even here, we find ourselves clinging to life rafts – USD stablecoins – tethered to the very system we sought to escape. Why? Convenience? Habit?

The Paradox of USD Stablecoins:

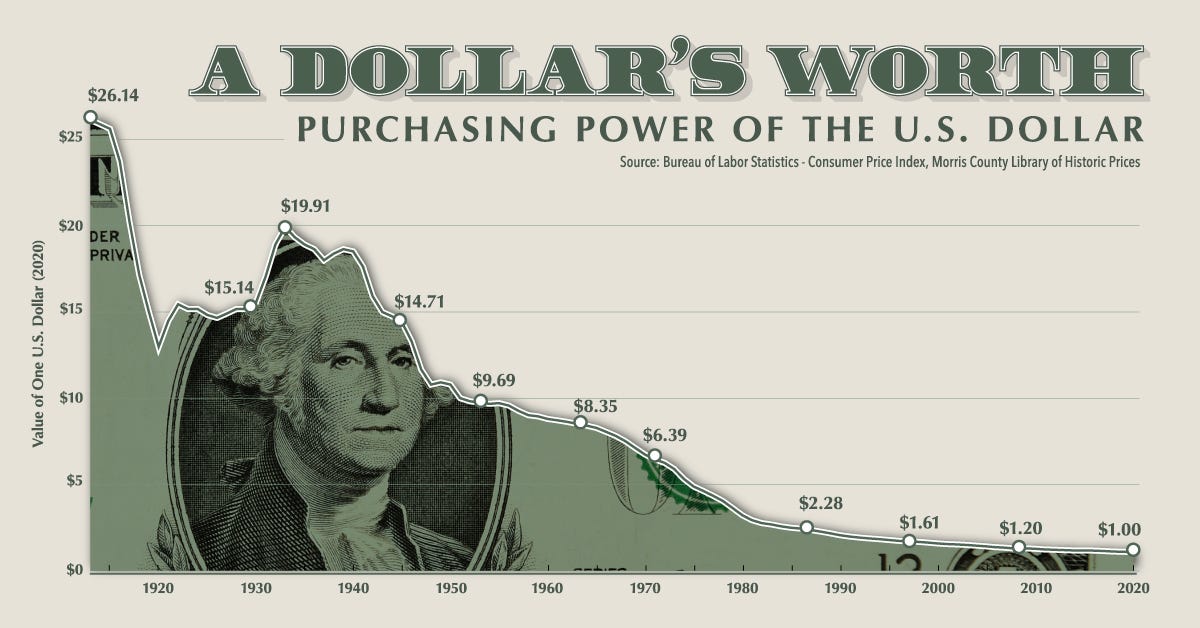

USD stablecoins offer a semblance of stability compared to the inherent volatility of many cryptocurrencies. However, this stability comes at a significant cost – exposure to the same inflationary pressures that plague traditional fiat currencies. The ever-increasing supply of USD directly impacts the purchasing power of these stablecoins, essentially eroding the value of your crypto holdings over time.

Imagine diligently accumulating a stack of USDC, only to see its ability to purchase real-world goods and services diminish due to factors entirely outside of the crypto ecosystem. This is the unfortunate reality of relying on USD-backed stablecoins.

If you are a Ray Dalio fan, you must have watched this video. Its a good video explaining how the superpower country always ends up falling and financial crisis leads to war and forming of new superpowers.

Just because we were born in this system, doesn’t mean we have to live with it. With the crypto revolution by our side, we have a new potential solution to this humongous crisis.

Beyond Fiat: The Rise of Flatcoins

Enter the flatcoin, a revolutionary concept that breaks free from the shackles of fiat. Unlike their USD-pegged counterparts, flatcoins derive their value from a carefully curated basket of real-world assets.

These assets are meticulously chosen to exhibit inverse correlation, meaning they tend to move in opposite directions. By incorporating commodities like gold, bonds, equities, and even other stablecoins, flatcoins aim to achieve superior long-term stability. This diversification strategy functions like a well-built portfolio, offering resilience against the economic storms that often wreak havoc on individual assets.

But why we are pegging to real-world assets (RWAs)

Money is just a number in a database, only goods and services provide value.

- Elon Musk

If you think deeply about the question “What is money?”, you might end up with the same old textbook definition of “exchange of medium”. But is it?

If I say gold is just a yellow shiny stone, I am not wrong. Just because the entire human society collectively values gold because of its chemical properties and its scarcity, it has value. The only true value additions are goods and services, we just use money as a universal database to settle the value of these goods and services.

Thus, when all fiat currencies fail eventually having a currency which is pegged to RWAs sounds like an adoptable financial standard.

Here's a deeper dive into why flatcoins are poised to be a game-changer:

Hedge Against Inflation: The diverse asset basket of flatcoins mitigates the impact of inflation on any single asset within the basket. This diversification provides a shield against the value-eroding effects of continuously printed fiat currencies.

Enhanced Security: Flatcoins inherit the inherent security of the blockchain they're built upon. This translates to a transparent and tamper-proof system, fostering trust and confidence within the user community.

Community-Driven Governance: Unlike traditional systems controlled by centralized authorities, flatcoins often empower users through governance tokens. These tokens grant users the right to actively participate in crucial decisions, such as modifying the composition of the asset basket or altering key parameters of the flatcoin system. This fosters a more democratic and inclusive financial system.

Can you guess what is the market cap of stablecoins in the crypto world currently?

Have a look.

USA is falling under an Everest of debt, 34 Trillion dollars at the time of writing this, you can check the live statistics here. The short-sightedness of the USA government and the pilation of all the money printing over the years as well as the attempt to weaponizing the dollar against the world has helped dig the dollar’s grave.

We have seen hyperinflation happening in some parts of the world, Argentina, Venezuela etc. It’s not new, people have suffered a lot in these countries. But what happens when the global reserve currency of the world goes through hyperinflation?

How do we protect ourselves from this imminent crisis?

The Call to Action: Embrace the Flatcoin Revolution

As crypto pioneers, we are early adopters, constantly challenging the status quo and pushing the boundaries of the financial landscape. We must not become complacent, accepting the limitations inherited from the very system we sought to escape.

It's time to embrace the transformative potential of flatcoins and actively contribute to building a more equitable, transparent, and inflation-resistant financial future. By joining the flatcoin revolution, we can collectively shape a financial system that empowers individuals, fosters collaboration, and ushers in a new era of financial freedom.

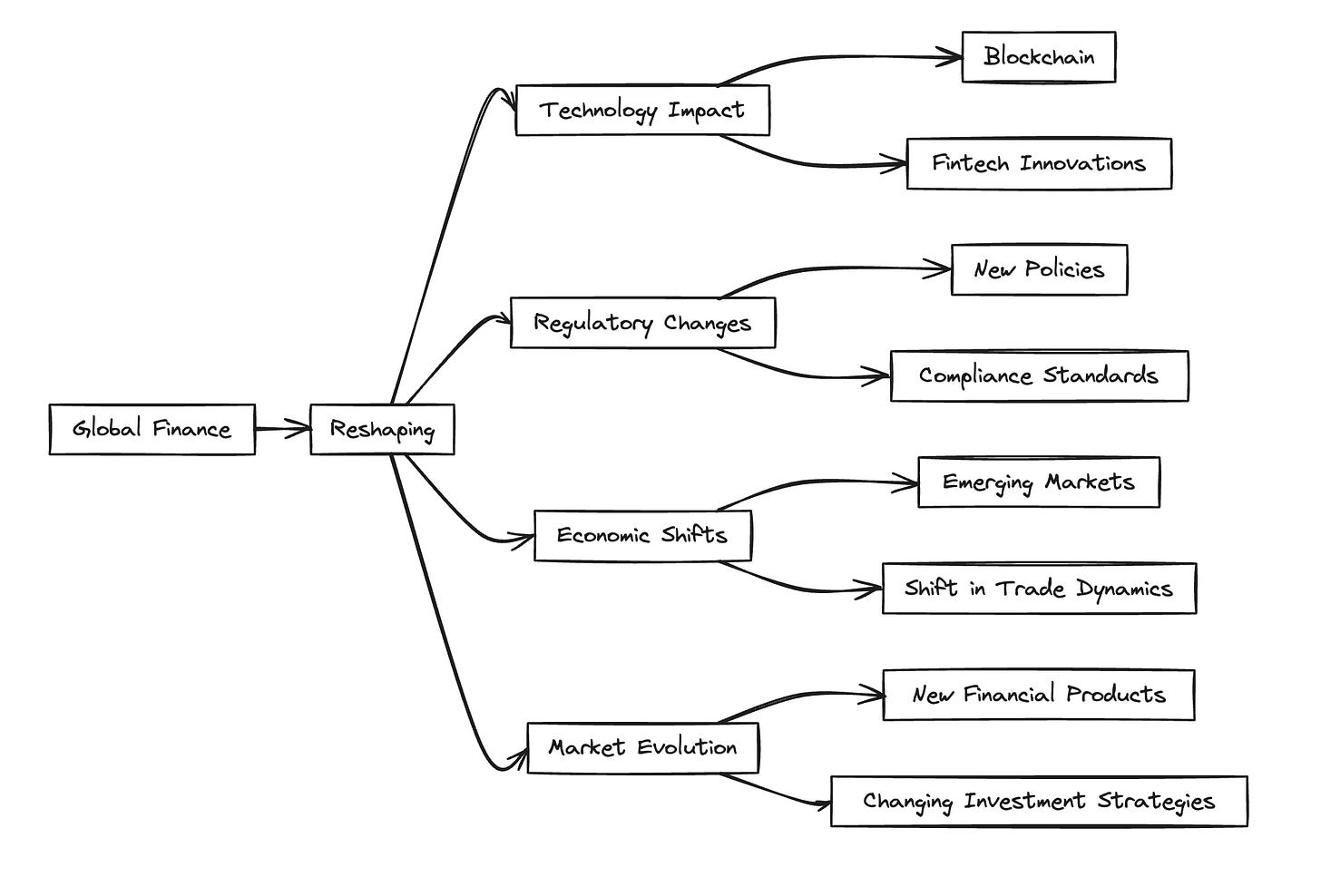

While initially focused on addressing the shortcomings of USD stablecoins within the crypto ecosystem, the underlying principles of flatcoins hold immense potential to extend beyond the crypto sphere. The concept of diversifying across a basket of real-world assets to create a more stable and inflation-resistant store of value could find applications in various sectors, including:

Personal Finance: Flatcoin-like instruments could offer individuals a more secure alternative to traditional savings accounts, potentially mitigating the erosive effects of inflation on long-term savings goals.

Retirement Planning: Pension funds and retirement accounts could potentially utilize flatcoins to achieve a more balanced and resilient asset allocation strategy, safeguarding the retirement security of individuals.

International Trade: Flatcoins could facilitate smoother cross-border transactions by eliminating the complexities and fluctuations associated with traditional currencies.

The potential applications of flatcoins extend far beyond the immediate realm of cryptocurrency, offering a glimpse into a future where individuals and institutions alike have access to secure and inflation-resistant financial instruments.

The Road Ahead: Navigating the Future of Flatcoins

While flatcoins offer a compelling vision for a more stable and equitable financial future, several key areas require careful consideration before widespread adoption becomes a reality.

1. Regulatory Landscape: Flatcoins currently operate in a grey area, with regulations still evolving. Establishing clear and comprehensive frameworks is crucial to ensure consumer protection, prevent misuse, and foster responsible innovation. Collaboration between developers, regulators, and the broader financial community is essential to navigate this complex landscape and ensure the sustainable growth of flatcoins.

2. Market Volatility: While the diversified asset basket aims to mitigate volatility, broader market fluctuations can still pose challenges. Continuous monitoring and adaptation of the basket composition may be necessary to maintain optimal stability during periods of heightened volatility. Additionally, robust risk management strategies are essential to protect users from potential losses.

3. Technological Advancement: Ensuring the smooth operation and widespread adoption of flatcoins requires ongoing development and innovation. Scalability solutions need to be developed to handle increasing transaction volumes without compromising efficiency and security. Furthermore, continuous research and development efforts focused on blockchain technology are crucial to ensure the long-term sustainability and security of flatcoin platforms.

Beyond the Challenges: A Vision for a New Era

Despite the challenges, the potential benefits of flatcoins are undeniable. They offer the potential to:

Empower individuals: Provide secure and inflation-resistant stores of value, particularly for those in regions with high inflation or limited access to traditional financial services.

Transform institutions: Offer pension funds, insurance companies, and asset management firms the opportunity to create more balanced and resilient investment portfolios, potentially leading to improved risk management and enhanced returns for investors.

Reshape global finance: Facilitate smoother cross-border transactions by eliminating complexities and fluctuations associated with traditional currencies, potentially fostering greater global economic integration and collaboration.

The journey towards a flatcoin-powered future has only just begun. Staying informed, engaging in open discussions, and actively participating in the development of this new ecosystem are crucial steps towards realizing the transformative potential of flatcoins. Together, we can shape a financial system that empowers individuals, fosters innovation, and paves the way for a brighter and more secure tomorrow.