Democracy is the worst form of government, except for all the others that have been tried.

- Winston Churchill

Humans have always been about forming communities. No matter if it’s over your favourite celebrity, your political opinions or even your favourite Pokemon ( I choose Pikachu ). As communities grow, institutions are formed, governments are created and the faith of the entire community now revolves around the ones who lead it.

Generally, one person leading is frowned upon and has more problems than the benefits they bring. That's why democratic systems emerged, aiming to distribute power among many, theoretically preventing the tyranny of a single individual. However, democracy, while celebrated as a cornerstone of modern society, is not without its flaws.

One of the major drawbacks of democracy is its susceptibility to populism and short-term thinking. Elected officials often prioritize policies that ensure their reelection rather than those that are beneficial in the long run. This short-term focus can lead to decisions that may yield immediate benefits but have detrimental consequences for future generations. Additionally, the democratic process can be slow and cumbersome, hindering the government's ability to respond swiftly to pressing issues.

There are numerous cases of various institutions and countries having a downfall because of lousy leaders and that leads to the suffering of millions.

What if there was another way?

With the top smart contract platforms such as Ethereum and Solana, we were able to replicate the existing widely accepted way of governance which is Democracy on-chain. Hundreds of Decentralized Autonomous Organizations (DAOs) exist on-chain and collectively take the decision such as crowdfunding or which NFT to ape in next. But these DAOs also face problems like

limited participation as an average Joe might not care enough

more voting power lies in the hands of a few major stakeholders

Governance deadlocks

What if we incentivize participation and create a system that not only addresses these challenges but also makes decentralized decision-making fun and engaging?

Enter Futarchy.

WTF is Futarchy?

Futarchy as a concept was introduced in 2000 by Robin Hanson, yep, it’s that old. It puts up a new perspective towards voting. It puts this idea on the table that we can incentivize long-term good behaviour in a decentralized group via voting on values.

Sounds too good to be true? Let’s find out

Let’s break the definition in a few different ways so that you understand.

The “Meme” definition:

The “Explain to me like I am a 5-year-old” definition

Futarchy is like a game where everyone makes guesses about what they think is the best decision. But instead of just counting the guesses, we also look at how sure people are about their guesses.

When people make their guesses about what decision to make, they have a chance to earn something called a "reward" if their guess turns out to be right. So, the more confident you are about your guess, the more reward you might get if you're correct! This encourages everyone to really think carefully about their guesses and try to make the best decision possible.

The “Boring with tons of jargon” definition

Futarchy, in its most technical form, can be defined as a collective decision-making framework that leverages prediction markets to forecast the future outcomes of proposed actions.

Core Mechanism:

Prediction Markets: Participants allocate tokens (representing belief) to two markets associated with each proposal: one for success and one for failure.

Price Discovery: The market price for each outcome reflects the collective prediction of its likelihood.

Decision-Making:

Impact Estimation: The estimated impact of a proposal on each participant's token value is calculated using the difference between the success and failure market prices.

Collective Choice: If the aggregate estimated impact is positive, the proposal is approved. Otherwise, it is rejected.

Key Features:

Information Aggregation: Prediction markets efficiently aggregate diverse information and opinions into a single price signal. As some people might have expertise in the topic,

Incentivized Participation: Participants are motivated to make accurate predictions due to potential rewards or token value changes.

If it still doesn’t make sense, there is an example down the line about the lifecycle of a proposal, that should clear things out.

How do we implement Futarchy? Why is it possible now?

We don’t have any huge organization implementing Futarchy, yet. You ask why? Well because we didn’t have the correct platforms to implement it earlier. Futarchy calls for a decentralized voting mechanism on a trustless platform.

We didn’t have smart contract platforms back in the 2000s but we have now. There is some research about doing Futarchy on other blockchains like Ethereum and Polkadot but these chains have their issues like scalability etc.

Why does Futarchy on Solana make sense?

Solana is the blockchain which has brought tons of qualities to the table which no other blockchain has provided

High throughput and low fees

Localized Fee Markets

Monolithic Architecture ( helps with maintaining everything in the Global State)

Tons of innovations to keep making it better like new clients, token extensions, and a vibrant dev ecosystem

Solana’s parallelization helps with processing thousands of transactions per second and its localized fee markets help to keep the fees low even though one part of the network is getting high traffic. This feature is very much needed for making prediction markets in such a way that it doesn’t affect other parts of the blockchain network.

Now let’s talk about how the concept of Futarchy would go through on a blockchain.

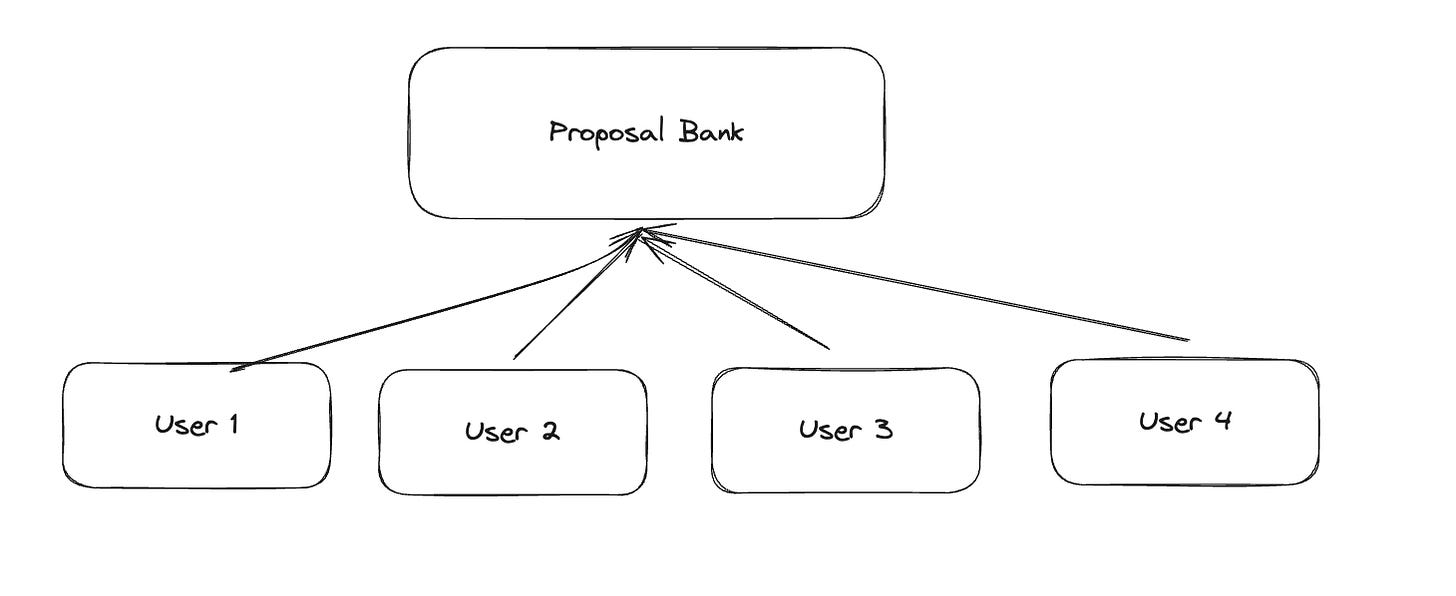

Proposals are passed in a proposal bank, which can be a website where everyone puts up a proposal regarding something. We can have a proposal creation fee to avoid getting spammed.

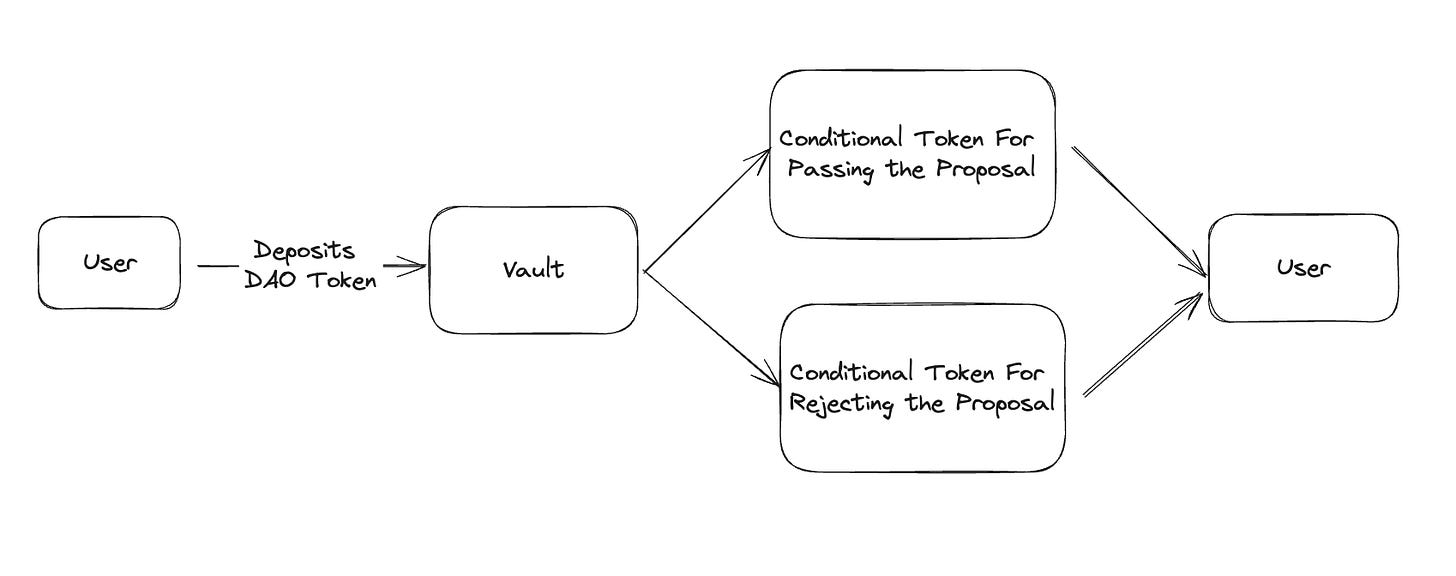

Each proposal would have 2 outcomes if it passed or failed. So let’s provide users with 2 types of tokens.

After depositing a token ( this is a token issued by the DAO ), the user is given 2 conditional tokens. These conditional tokens would help the user to trade in the prediction markets. Consider these like Monopoly tokens ( yes, the game ). Now the user is free to trade using both these tokens.

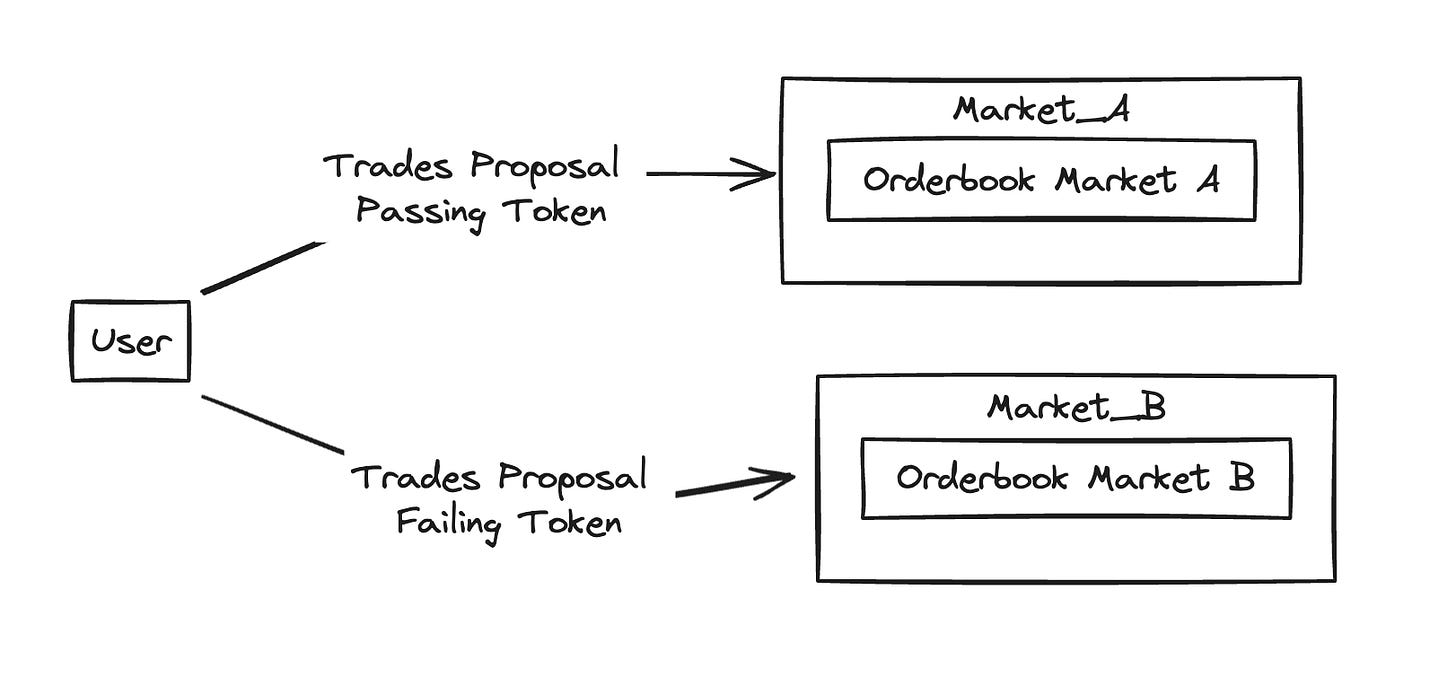

These are free markets now, and all the traders would try their best to make a profit, I mean who doesn’t like making money right? At the end of the trading period, whichever token’s value (Proposal Passing Token and Proposal Failing Token ) is higher, that result is executed. All the trades of the losing markets are reverted.

This should clear some concepts of how the flow looks. There are still some caveats to these, can you see them?

What if someone with a lot of funds, manipulates the market?

We use Time Weighted Average Price ( TWAP ). The reliance on price discovery over a period of time would make it less effective for an individual to try to manipulate the outcome with a brief, targeted price spike. They'd need to sustain that manipulation over a longer period.Who executes the proposal at the end of the trading period?

An automated open-sourced smart contract that is instructed on both conditions of the proposal executes that instruction after the results of the trading.Is the Futarchy approach scalable?

When we talk about the word scalable, we should talk about it in 2 directions, macro and micro.

Is Futarchy good for Macro decisions? Yes, if the decision is big and a huge group of people are affected by it, all of them would be incentivized to take part in the trading and thus help with the decision-making.

Is Futarchy good for Micro decisions? Currently no, but there are a bunch of potential approaches to make it better for micro decisions. Some of the approaches are:Threshold-Based System: Implementing a threshold system where only decisions exceeding a certain impact threshold would be subject to futarchy, while smaller decisions could be handled through alternative governance mechanisms like delegated voting or snapshot voting.

Bundling Similar Decisions: Grouping related or similar low-impact decisions into a single prediction market could streamline the process and reduce the burden on participants.

Alternative Futarchy Mechanisms: Exploring alternative futarchy mechanisms that are more lightweight and scalable for frequent decisions, such as reputation-based systems or simplified prediction market designs.

Why is MetaDAO the talk of the town all of a sudden on crypto Twitter?

If something gets popular on crypto Twitter, it’s definitely something which has a good monetary value. It’s a simple thing, deep down all humans are greedy. In fact greed is one of the only human emotions one can trust blindly. We can always expect a human to be greedy. On this philosophy the entire blockchain industry is secured, we pay people to keep the network secure.

MetaDAO is working on creating a self-sustaining DAO which runs on Futarchy. The DAO has its token called “META”. This token is used to run those Futarchic proposals. Users trade conditional tokens and the market which has a higher price for Meta wins the decision.

The innovations MetaDAO is working on

Addressing DAO Challenges: It tackles the issues of limited participation, unequal voting power, and governance deadlocks that plague traditional DAOs.

Fun and Engaging: The gamified prediction element makes participating exciting and rewarding, encouraging active involvement in the DAO's decision-making process.

Potential for Wider Adoption: MetaDAO's success could pave the way for the broader adoption of Futarchy in various organizations, not just in the crypto space.

MetaDAO is constantly working on making the DAO so robust that it doesn’t need to rely on anything or anyone. So yes, all the features we talked about earlier, MetaDAO is bringing them to reality. MetaDAO is also adding more features other than the basics of Futarchy. Here are some key features that set it apart:

Dual-Market System: Each proposal has two markets: one for success and one for failure. This allows for a more nuanced assessment of the potential impact on the DAO's future.

Time-Weighted Average Price (TWAP): This mechanism ensures price manipulation doesn't sway decisions. TWAP considers the average price over a set period, giving a more accurate picture of market sentiment.

Conditional Tokens & Vaults: These innovative tools simulate the "reversion" of unsuccessful trades, ensuring fairness and preventing token losses for participants.

Other than all the innovative work, META token’s price also played a huge role in gaining the attention of Crypto Twitter. So when the META token became available to buy on spot markets, it saw a crazy price increase and that helped gain the attention of the degens on Twitter. Price always helps in gaining attention.

How MetaDAO can lead the way from here?

MetaDAO is still in its early stages, but its potential impact on the future of decentralized governance is significant. At the time of writing this article, Proposal 10 is going through the process of decision-making.

Thanks to the awesome ability of Solana to sync the global state at the speed of light, MetaDAO can use the awesome architecture it has built to integrate with other protocols.

Every protocol sooner or later has a governance token, and instead of the democratic way of managing the proposals, using Futarchy would be a good experiment. This might encourage people who have the intelligence to help with the proposal to use their expertise to make a quick buck.

As MetaDAO attracts more participants and token holders, its network effects come into play. A larger user base leads to:

Increased liquidity: More participants contribute to the prediction markets, ensuring smoother operation and accurate price discovery.

Enhanced diversity: A wider range of perspectives leads to more informed decision-making and a more robust DAO ecosystem.

Greater collective intelligence: The combined knowledge and experience of a larger community foster better predictions and ultimately, better outcomes for the DAO.

The Key Performance Indicator (KPIs) of Futarchy against Democracy can be tested by some metrics such as:

How many people take part in the decision-making

How fast the decision takes place

Which approach is more robust against manipulation in production

Which approach leads to long-term beneficial decisions

Even though Futarchy might look superior on paper, we should wait for it to actually take place on a wider scale and then we can compare the report cards later.

Concluding that MetaDAO's experimentation with Futarchy represents a bold step towards reimagining how communities can make decisions. While the future remains uncertain, its potential to address the limitations of traditional governance models and pave the way for a more engaged and empowered future is undeniable. As MetaDAO continues to evolve and attract participants, its influence on the world of decentralized governance has the potential to be truly transformative.

Thanks for reading, hoping you enjoyed it!!

References: